ABOUT VCAPITAL INVESTMENT JOINT STOCK COMPANY

Vcapital Investment Joint Stock Company aims to become a leading prestigious trading and investment group in the field of construction machinery and equipment business. This is also one of VITRAC's potential partners in the coming time.

DEVELOPMENT JOURNEY OF VCAPITAL INVESTMENT JOINT STOCK COMPANY

- 2011: VCapital Investment Joint Stock Company was established.

- 2012 to 2014: Main activities in the field of financial investment.

- 2015 to 2017: Vcapital expanded its operations to the field of selling and leasing construction machinery and equipment for mining. Stable revenue growth.

- 2018: Rapid development, estimated revenue reached 170 billion VND. At the same time, establish a close cooperative relationship with reputable manufacturers and suppliers of machinery and equipment in the world.

- 2019 to 2025: Revenue growth and sustainable development through:

+ Diversifying product offerings.

+ Building strategic partnerships with many manufacturers and suppliers.

+ Improving service quality.

+ Strengthening the system and developing a team of dedicated and professional personnel.

BUSINESS AREAS OF VCAPITAL INVESTMENT JOINT STOCK COMPANY

1. Distribution of construction machinery and equipment

Vcapital has gradually affirmed itself as a reputable supplier and consultant for the purchase and sale of construction machinery and equipment to individuals and businesses operating in the fields of construction, transportation, construction and installation, and mining.

- Vcapital is the official distributor of Nano in Vietnam. Nano is a manufacturer and supplier of honeycomb catalysts and SCR plate catalysts. The company provides products for use in thermal power plants, industrial boilers and shipyards, incinerators, and chemical plants. Nano was founded in 1999 and is headquartered in Sangju, South Korea.

- Vcapital provides new and used Cat brand products in Vietnam including: construction & mining machinery, generators and industrial engines, marine engines and forklifts. Cat's product range includes over 300 types of equipment that have been and are setting standards.

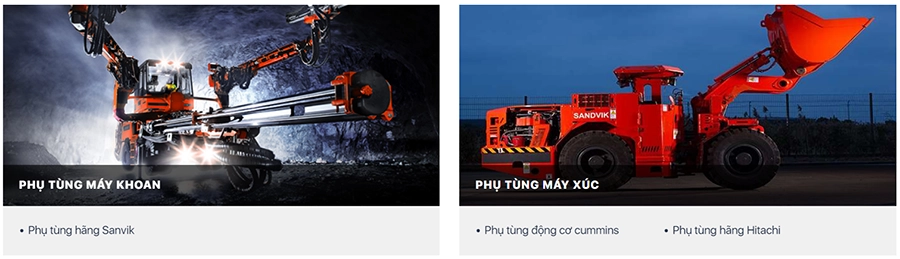

- The company also provides specialized drilling rigs of the Sandvik brand in Vietnam. Sandvik is a leading manufacturer of reliable and efficient mining and tunneling drilling technology, increasing productivity and reducing time for customers.

- In addition, they provide lines of crawler cranes and truck cranes of the Terex brand. Terex is the world's leading manufacturer of cranes. With a large customer support system and financial solutions, Vcapital will help contribute to the success of its customers.

In addition to the machinery business, Vcapital also supplies a variety of mechanical spare parts.

2. Providing financial services

Investment consulting

Since the end of 2008, grasping the market demand, VCAP has coordinated with securities companies to provide listed securities investment support services to customers of securities companies. The service has attracted the attention of a large number of investors from individuals to organizations. With the initial deployment at partners such as SSI, VNDirect and KimEng, the total circulating disbursed capital of VCAP has reached 300 billion VND to hundreds of customers, supporting investment in good stocks with high liquidity. listed on the market. Benefits of the service:

- Disbursement within the day

- Can request an extension

- Have the right to realize profits early

- The list of accepted securities for cooperation is wide open

- High capital contribution ratio helps strengthen customers' financial capacity

- Investment securities and all rights related to such securities will still belong to the customer during the term of the contract.

- The profit sharing ratio for VCAP is fixed and reasonable, ensuring proactive investment decisions for customers

Asset exploitation

Asset exploitation is a specific financial service deployed by the company since 2009 to serve the specific needs of each different customer. With many years of experience in the financial sector in the Vietnamese market, VCAP's Asset Exploitation service will act on behalf of customers to achieve profit-seeking goals according to individual needs. In which, VCAP Company is entrusted with exploiting the assets entrusted by customers, which will help customers have more time to focus on their main business activities.

Before participating in this service, depending on the investor's risk tolerance, our dynamic management team will advise and propose a specific implementation plan based on the investment objective of maximizing profits or seeking stable and long-term income. Benefits of using the service:

- Products ensure flexibility and high adaptability

- Contracts are in line with customer's profit expectations and risk tolerance

- Customers are regularly updated on the asset situation as well as investment performance

- Information about the customer's investment activities is kept confidential The target customers that we focus on serving include:

- Domestic and foreign individuals and organizations with accumulated capital.

- Want to invest, but do not directly make investment decisions due to lack of time and expertise to invest effectively

- Have a need for medium & long-term capital management

Capital support

The securities repurchase agreement (Repo) service is a traditional service of VCAP since its establishment. After nearly 3 years of implementation, the total value of VCAP's Repo securities purchases has reached more than 100 billion VND. Repo securities are very diverse, from government bonds to shares of large commercial banks, construction corporations, real estate, and sea transport... Repo services have brought VCAP about 10 billion VND in revenue. Benefits of the service:

- Immediately meet capital needs without having to explain the reason for using capital.

- Increase the customer's available capital

- The list of repo securities is regularly updated.

- Simple and fast procedures.

- Honest, responsible and professional staff.

- Have the right to early termination or can extend the Term Purchase and Sale Contract, up to 12 months.

- All rights related to such securities will still belong to the customer during the term of the contract.

Investment trust

With abundant capital, diverse in mobilization sources and terms, VCAP always seeks reliable partners for investment trust to optimize cash flow and maximize profits. VCAP is interested in all forms of investment trust, including:

- Investment trust without specifying the purpose, enjoying a fixed interest rate.

- Investment trust with a specified purpose, enjoying a fixed interest rate.

- Investment trust with a specified purpose, sharing risks.

With the form of trust with a specified purpose, through partners who are reputable securities companies, VCAP has placed an order to buy more than 50 billion VND of market price of securities, bringing about 5 billion in revenue. With the form of trust without specifying the purpose, VCAP has also supported nearly 50 billion VND for other credit financial institutions.